The COVID global pandemic was one such phenomenal event that incited the deepest convictions of the politicians. Thus, when the idea of lockdown was mooted to right wing politicians like Boris Johnson (Boris Johnson fashion himself to be like British wartime prime minister Winston Churchill) and Donald Trump, they snapped that it is ‘totalitarian’ and anti-business. They vacillated to make the decision, while the express train of the pandemic run over the countries. Those who did not ideological opposition to lockdown like the premier of Newzealand Jacinda Ardern, however, were not perturbed by the concept of lockdown. They did what they are supposed to do in the right time. Of course, they had the financial mettle to do so.

What is the connection John Maynard Keynes and Milton Friedman have with the overall failure of Indian lockdown?

Nothing direct. But as Nehru has connection with everything wrong in the contemporary Indian “WhatsApp universities”, these two men can also bear some blame.

The long story is as follows. I have deliberately kept it long to address all the ‘usual suspect’ questions emerging when we discuss the issue.

REVERSE MIGRATION AND THE SPREAD OF COVID

Everyone agrees that one of the most devastating consequences of the Indian lockdown was the migrant workers crisis and the resultant reverse migration. The reverse migration can take the blame for the spread of the COVID across India. The continued rise of the contagion graph even after the two months of lockdown has direct bearing to the mass exodus of migrant workers.

To begin with, I don’t doubt the timing of Indian lockdown. It was quite appropriate. But what was not initiated timely was the financial relief for those who are immediately affected by the lockdown.

The migrant workers started to walk back to their villages after waiting for almost 4-6 weeks when they felt total desperation. In fact, many took the task of returning back just to let themselves die in their hometown. For people who were exhausted of all their resources, there was nothing to choose by- death by COVID was nothing compared to death by starvation in a distant land.

WAS REVERSE MIGRATION PREVENTABLE?

Was this reverse migration preventable?

Was there a magic wand that could have prevented the exodus of desperation?

Yes. And quite an easy one. Very much within the reach of the government.

But something which was not used.

Before we know about this magic formula and why it was not used, let’s see what was the balm the government made us believe that it did indeed apply?

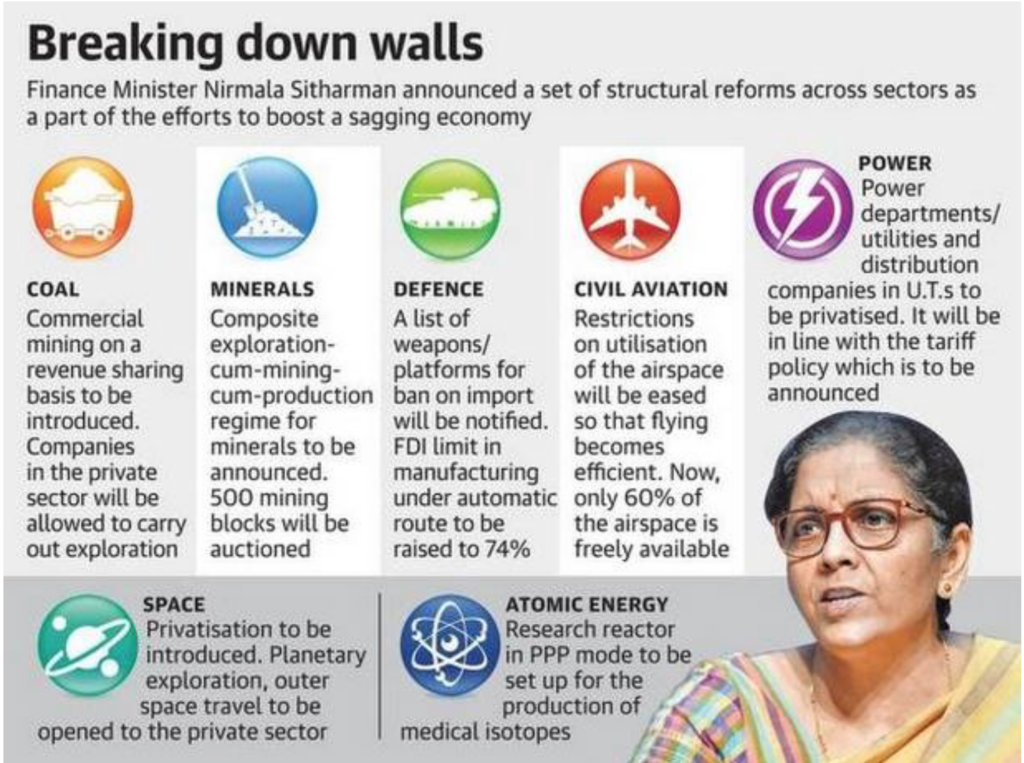

In April-May 2020, Indian Finance minister, Nirmala Sitaraman announced a series of finance package, ostensibly as a relief for COVID pandemic induced economic slowdown.

https://indianexpress.com/article/india/nirmala-sitharaman-coronavirus-economic-package-reform-6413632/

The following was the list of measures announced in the early weeks of May 2020.

1. Privatization of coal blocks allocation

2. Indigenous manufacture of small arms for the military

3. Postponement of loan payment for industry

4. Private-public partnership for atomic and space industry

When the lockdown induced financial distress was staring at the Indian Public, the Finance minister was talking about coal block allocation, indigenous manufacturing of weapons for the army, and privatization of space and atomic industry.

THE MISSING CONCERN

Was something amiss?

Yes. There is something was grossly out of place- Sitaraman’s approach was reflective of the contemporary orthodoxy of economic thought in the echelon of finance ministry- mostly manned by people who have studied in economic schools in the United States. This include IAS officers who take sabbatical to study public administration in US Universities. Most of them are indoctrinated by an influential group of economists widely known as the “Chicago school”.

KEYNES, FRIEDMAN AND THE HIGH PRIESTS OF ECONOMICS

The ‘mastermind’ of this school of thought was Milton Friedman. Friedman was the winner of 1976 Nobel prize for economics, and was the advisor to Ronald Reagan and Margaret Thatcher. He is a champion of the “neoclassical economist approach”, which advocate to free the market from all types of policy interventions, under the classical liberal economics belief that recession and slowdowns in the market will auto-correct itself, and the government should be only involved in managing the supply of money to the banks. They were called ‘Monetarists’ as against the older orthodoxy of ‘Keynesian’ school of thought who would advocate heavy interventions by the state to set right the fluctuations in the economy and the market.

The Keynesian system was eponymous of John Maynard Keynes, another influential economist who changed the course of traditional classical economic thought that the free-market would set rights its own minor aberration in growth and employment like economic recession.

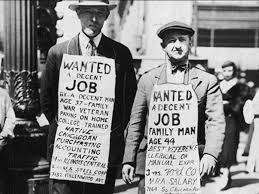

What catapulted Keynesian theories to prominence was the effect of Great Depression of 1929 when world GDP plummeted 15% for almost a decade, with severe complications across the world (to compare, the fall in world GDP during 2008 economic crisis was just 1% of GDP). Great Depression followed a crash in Washington stock in 1929. The investors who lost in the crash started to drastically reduced their expenditure. This affected spending in the economy and the resulting cascading effect in agriculture and manufacturing causing massive unemployment and deflation.

The gloom in the American market spread across to the whole Europe and the wider world with millions of people descending into prolonged unemployment, poverty and destitution- until something happened: The World War II.

WORLD WAR II AS THE SAVIOUR OF AMERICAN ECONOMY

As the WWII broke out, the American industry was forced to produce supplies for the warring allies. The businesses that had all closed down because of poor demand quickly revived to produce military equipment. The government issued cash to spur industry, and the industry took on the lead – even though there was a lurching chance of default by the government (which would have prevented industrialists to invest believing the government in normal civilian circumstances).

With the World War, the American industry that was all dead reemerged, and unemployment rate decreased to historical low- the depression was gone, and the economy was back into its form. As a matter of fact, the economy was showing sprouts of improvement before the war when the US President Franklin Roosevelt announced massive government spending under the ‘New Deal’ policy. But it was the war was that spurred the industry like never before.

Now, the principle of massive public government spending when the economy goes into recession is what Keynes advocated based on his analysis of the dynamics of the economy. His theory was that economy goes into recession when a confluence of bad sentiments (and bad events) piles up and people stop spending in anticipation of bad times. When spending declines, industries fail, causing a vicious cycle of lockdowns and unemployment. Unemployment creates further reduction in demand and further slowdown in the market, and the vicious cycle leads in worst scenario to protracted economic depression.

According to Keynes, the prescription in such a scenario is massive public spending by the government. Keynes advocated that the government should spend even if it did not have money. It should issue bonds, or even print money and spend heavily until the economy revives. This policy of the managing the economy by increasing government spending is called “fiscal- side management” of the economy.

After the success of Keynesian intervention in the mid-20th century, it became the orthodoxy of the policy makers in most part of the world. Keynes economics was employed whenever economy started to slow down. Also, because of the ‘tutelage’ of the Keynes model, most of the Western economies post war started to invest in public infrastructure and public welfare measures notwithstanding the prevalent financial status of the economy. In fact, the US provided credit lines for massive public spending under the Marshall plan for postwar reconstruction of Europe including the reconstruction of captured Axis nations like Germany and Japan.

LABOUR UNIONS MILITARISM AND THE DECLINE OF SOCIAL WELFARISM

However, over a period of time, politicians started to use the justification of Keynes economics to advocate populist measures to turn around electoral defeats. This short-term application of Keynesian principles lead to massive public debts in most of the Western economies. The public sector industries were heavily pampered, and most of the public sector industries started to incur huge loss. The labour unions became powerful, and turned increasingly demanding, making running viable business almost impossible.

It is in this context the school of thought spearheaded by Milton Friedman came into fore. They reinterpreted the economy data of the Great Depression and argued that the economy went into depression because the government did not do anything when the banks started to collapse after the stock exchange fall of 1929. They said that had the government helped the banks and prevented their liquidation, the depression could have been avoided. Freidmanian prescription in the eventuality of an economic crisis was to save the financial institutions by providing funds and other doles to key financial institutions-mainly banks- from collapsing; they were vehemently against government spending to revive demand. In fact, they were of the view that government should not intervene in the market other than by providing enough money supply to the banks (i.e. liquidity in the economy). The market, according to them, would readjust itself on its own. This school of thought is known as “monetary management” of the economy. So, if you have inflation, the central bank is advised to take measures to reduce money supply (like increasing the interest rate), and if there is slowing of the economy, the prescription was to increase availability of credit (by reducing interest rates and in certain situation supply extra credit funds to the market).

EMERGENCE OF THE NEW MACRO-ECONOMIC ORTHODOXY

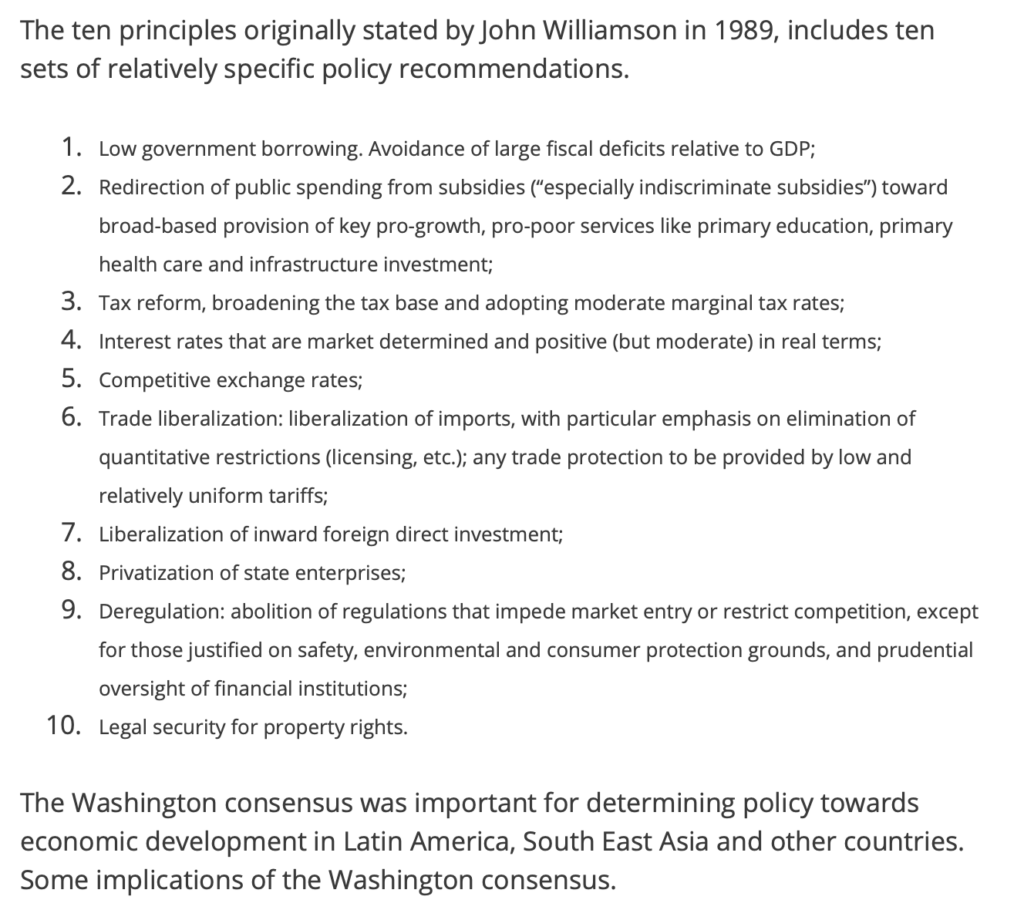

After many decades of misuse of Keynes economical measures by politicians, Friedmanian apologists advocated the opposite of what Keynes recommended- of limiting government expenditure within a restriction of a ‘fiscal deficit’. This means that the governments were not supposed to spend beyond a margin imposed by the fiscal limits of the budget. They also advocated privatization of public sector industries and ‘liberating’ government from being a “industrialist”. Economists who believed in Friedman’s approach gravitated to University of Chicago and evolved as what is known as the “Chicago school”. Sooner than later, Chicago school became the ‘orthodox’ school of economics in the West. They inspired the policies of leaders like Ronald Reagan and Margret Thatcher. Thus, by 1980s the public spending welfare governments were replaced by miserly spending governments that were extra careful in spending beyond the fiscal limits set arbitrary by the Chicago school, and propounded by monetary agencies like IMF and the World Bank. (Incidentally, by that time, most of the Western economies had achieved a degree of human resource and healthcare development thanks to the generosity of the Keynesian policy frame work. But the situation was quite the contrary in most of the developing and underdeveloped countries). The policies of Chicago school was formalized as what is known as “Washington Consensus” ( see figure below).

WASHINGTON CONSENSUS

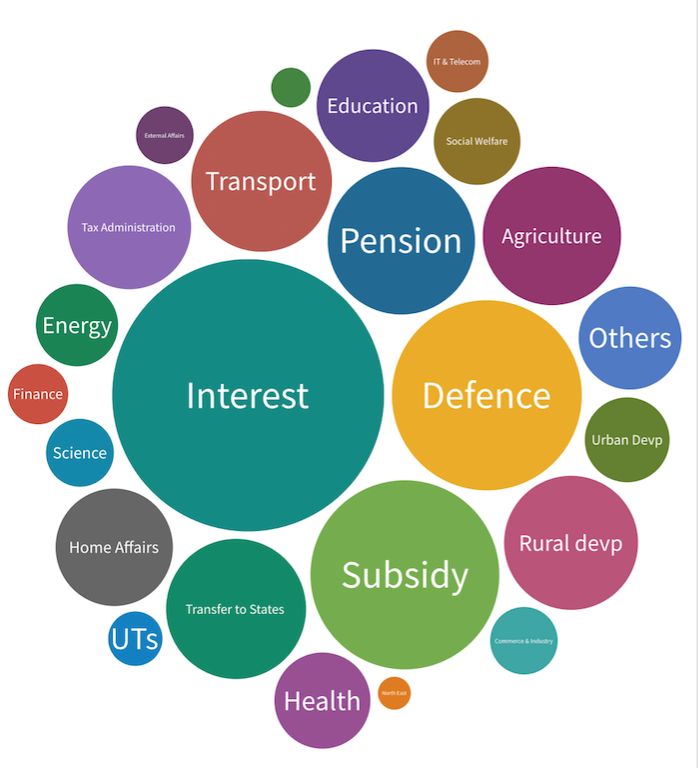

If any government spends beyond the fiscal limits, it is red flagged by the economy rating agencies. Once the rating of a country falls, it would have to pay more for getting foreign loans. Further, moneybags like Foreign institutional investors (FII) would take away their investment if the rating falls. If the FIIs take back the money, the value of the currency would fall (as they would be selling the concerned currency in large quantities). Due to fall in the exchange rate of the currency, the interest incurred to the existing loan term loans would increase, and would further cut into the budget. ( see cartoon showing the allocation in a typical union budget. The most important contribution is the interests paid to service loans the government took from various sources. If the currency exchange value falls due to exit of foreign investors incident to downgrading of the investment quality, the fraction of the budgetary allocation for interests would have to be increased. The bubble chart also shows that within the limits of fiscal discipline, the finance ministry has very little leverage in allocation of resources. An increase in allocation in one category would have to come at the cost of reduction of allocation for another category)

Now coming to India, most of the officials in the finance ministry are schooled in the prevalent Western orthodox economic thoughts. They religiously follow the policy prescription of the Chicago school. They consider the ‘fiscal limit’ as sacrosanct and one that should never be breached.

While the official economists and the finance ministry administrators follow the Chicago school, there is another group of economists who maintain an opposite stance. These are developmental economist like Jean Dreze and Amritya Sen and “Poor Economists” ( economists who study the economy of the state of being poor) like Abijith Banerjee and Ester Duflo. They advocate massive public spending on social and health sectors to take the poor out of poverty. The Mahatma Gandhi Rural Employment Guarantee Act (MNREGA) constituted by the United Progressive Alliance (UPA) was heavily influenced by advocacy by developmental economists in the National Advisory Council (NAC) during the UPA-1 regimen. At the point of initiation of MNREGA proposal there was strong opposition from the Finance ministry including from Finance minister Chidambaram and even Prime Minister Man Mohan Singh. However, it was a major electoral promise by the UPA, and under the influence of the Left who was externally supporting the UPA, it was accommodated in the budget (Now, it has emerged as a major poverty alleviation program including an effective way to provide relief for the displaced migrant workers )

The Developmental Economists and Poor Economists are different from the Chicago schooled babus in one cardinal trait. The former group people have all done original field-level work in the villages and slums of India. Amaryta Sen’s major work was on the great Indian famine of the 1940s and his thesis was that the famine was man-made because of wrong policies of imperial British government under Winston Churchill. Jean Dreze has worked extensively in the villages of North India. Abijith Banerjee and Ester Duflo had conducted seminal studies on Poor in North India and Indonesia.

The Babus of the North block, on the contrary, have mostly done their sabbatical in public administration schools in the US. They all have been taught how Zimbabwe and Venezuela have got into hyperinflation when they did not follow the dictates of the monetary institutions (What actually caused hyperinflation in Zimbabwe and Venezuela is an interesting topic in itself- I do not want to discuss it now- but suffix to say it is not because of the reasons cited by the Chicago school orthodoxy. There are much deeper reasons to it. Hyperiflation occurs when people loose faith in the ‘capacity’ of the government to pay in the future. We have to understand that the value of a currency as actually the value of the faith in the signatory of the currency. Nations are considered as ‘perpetual entities’. The debt of nations is not considered akin to debt of individuals, who have limited life span. Nations are ‘believed’ to exist forever. So as long as nations appear ‘trustworthy’ their debts are considered ‘viable’. In the case of Zimbabwe and Venezuela, the Western world had virtually shunned them from the global economy- this made trade with them almost impossible, making them “untrustworthy” and therefore their debts became “unserviceable”. The currency sheds its value when the authority that guarantees the note is considered “untrustworthy”). They have never seen first hand the wastage of human resources that happen due to poverty and malnutrition of the rural and urban poor. They only know about fiscal discipline and the scare of hyperinflation.

PRESCRIPTIONS FOR BOOSTING DEMAND: SOLUTIONS THAT FELL ON DEAF EARS

When the lockdown was imposed and the economy was on for a standstill, many leading economists advocated immediate relief to those who are the weakest link in the scheme things- viz the migrant worker who are stranded without job or income in urban settlements. Abijith Banerjee advocated direct cash transfer. Many social activists also advocated the same. Subramanian Swamy, otherwise a staunch right-wing opinion maker, recommended demand-boasting relief measures to the poor. This could have been easily done, as the Narendra Modi government had rolled out a zero balance bank account to the poor many years back. A direct cash transfer of 10,000-15,000 rupees would have reassured the migrants and prevented reverse migration in one go (In fact, the cost of direct money transfer would be less than the cost of population wide COVID PCR testing if the COVID spread throughout the country- something which is happening now).

But, instead, the Finance minister announced measures for privatization of coal block allocation and plans to locally manufacture firearms for the military!

The question arises that such a measure would require huge amount of money and how would government fund it. Here comes the insight Keynes had brought in when managing the Great Depression. When faced with a situation of great calamity, and when the market sentiments are gloomy enough to cause standstill of the economy, government need not worry of anything but to stimulate demand in the economy. Here, government should resort to every measure in its ambit including the extreme measures like what is euphemistically known as ‘quantitative easing’- of printing money. It would not lead to inflation because in situations where the economy is going to standstill, the event that is forthcoming is the contraction of the economy rather than inflation.

But Babus who are weaned on the limited vision of ‘fiscal discipline’ would not have anything of such a sort of idea. They would still cling of their tutorials of the “Chicago school”.

Indian lockdown failed precisely because the government did not care for the weakest link in the chain at the appropriate moment of time. In its indifference, it unlocked the COVID pandemic across the nation.

Here, the reason why the ‘weakest link’ was not cared is related partly to the principal ideology of the government.

WHY IDEOLOGY MATTERS

In my view, ideology that is practiced in a parliamentary democracy is n-1 the “degree of freedom”- here the avowed communist would become a socialist, a socialist would turn out as a capitalist and a capitalist would become a cultural bigot, and cultural bigots would mix socialism with capitalism. It all depends on how strong the exigencies of parliamentary democracy influence ones deepest convictions. It is clear that significant degree of dilution of ideology happens in parliamentary democracy. To what extend it happen, depends on the politician’s “ideological singularity”.

Politicians follow the advice of the bureaucrats as long as the deepest convictions are not breached. When the advice from bureaucracy starts to touch the most existential convictions, strong politicians would draw a line, and act by his or her ideology.

The COVID global pandemic was one such phenomenal event that incited the deepest convictions of the politicians. Thus, when the idea of lockdown was mooted to right wing politicians like Boris Johnson (Boris Johnson fashion himself to be like British wartime prime minister Winston Churchill) and Donald Trump, they snapped that it is ‘totalitarian’ and anti-business. They vacillated to make the decision, while the express train of the pandemic run over the countries.

In India, COVID Pandemic posed before the government one of the most difficult administrative challenge. Bureaucrats advised something, and politicians decided based on their convictions to take or throw what is appropriate to the situation.

This explains pretty much the differences in the administrative decisions taken by the central government and various state governments.

Indeed, Ideology matters.

Update to the post: This note was written in June 2020 when the COVID numbers were rising in India. Looking back at the note in Feb 2021, a day after the 2021 Union budget, it appear that honchos of the Government of India is coming in terms to the argument voiced in this article 8 month ago. The Economic Survey 2021, and the Union Budget 2021, indicate that the Government of India is going back to the Keynesian polices of doing away with the so-called “Washington consensus” of strict fiscal discipline. This is clearly a Leftist drift of the economic policy. It is almost similar to the post world war polices of the western European governments. As a matter of fact, it almost copy paste of the polices the Government of Kerala adapted in the recent 4 years.

Government of Kerala in the last 4 years never shied away from liberal public spending on borrowed money. Here, it created a major innovation. Instead of borrowing money from Western capitalist institutions like IMF and World Bank, it issues its own bond that is traded in rupees (rupee denominated rather than linked to the US dollar). Keralites across the globe have invested heavily in this fund. Because of this instrument, Kerala is not restrained by the demands imposed by agencies that follow ‘Washington consensus’ (which in turn is based on Milton Friedman’s economic philosophy, discussed in the post below). As a consequence Kerala’s GDP grew at a rate of 6-7% notwithstanding the effects of two devastating floods and the COVID pandemic.

Kerala has floated a fund agency called Kerala Infrastructure Investment Fund Board (KIIFB) for the purpose. I would rate KIIFB as major public innovation as were land reforms (1957-1969), education reforms/bill (1958), mass literacy campaign (1980s), people’s planning movement (1996) and the Kudumbashree woman empowerment program (1998). I think this is going to transform Kerala in a matter of 10-20 years, the way the previously cited programs did in the decades following. I am sure Central Government and other state government would follow Kerala’s example. The present Union budget is a clear pointer.

Here, I would consider Narendra Modi’s government emerging as an ‘economic Left, while it remains as culturally and legislatively a Rightist Government. The bottom line is that no Right wing government in a underdeveloped and diverse country like India can sustain itself with a traditional Rightist economic policy. A further subtext to this point is that the ‘crony capitalist’ aspects of the economic policies comes under the rubric of ‘Legislatively Right’ nature of the government. These points can being discussed using the matrix of Enlightenment values mentioned elsewhere in this site. I hope to discuss this point in detail in another post.

Hits: 975